Consumers expecting a check from the federal government may be surprised to receive a VISA debit card in the mail instead. If you receive one, be sure not to throw it away! The U.S. Treasury is mailing nearly 4 million Economic Impact Payments (EIP) by prepaid debit card, instead of by paper check. This reported allotment of cards is tied to qualified individuals without bank information on file with the IRS and whose tax return was processed by the Andover or Austin IRS Service Center. Thus, it is currently unclear how many Hawaii residents may receive their payment in the form of an Economic Impact Card. Nevertheless, this information is being shared to properly inform all consumers.

Prior messaging from the IRS indicated that they would not call, text, email, or use social media to request personal information, however, in this instance card recipients will need to provide their Social Security number to activate the card. The government assures the public that this prepaid debit card is not a scam.

The Economic Impact Card will come in a plain envelope from “Money Network Cardholder Services” along with information, instructions, and a note from the U.S. Treasury.

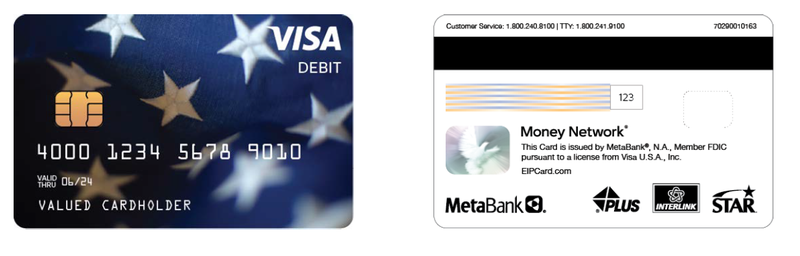

The Consumer Financial Protection Bureau (CFPB) states that it should look like this:

Be sure to check the back for the issuing bank’s name, MetaBank, N.A.

EIP Card recipients should follow the instructions included with the card to avoid incurring any fees when using it to make purchases, get cash from in-network ATMs, and transfer funds to their personal bank account. They can also check the card balance by phone, mobile app, or online. The card also provides consumer protections available to traditional bank account owners, including protections against fraud, loss, and other errors. The money does not expire. If all the money on the card is not used before the expiration date printed on the card, the cardholder can call customer service to request a refund check for the remaining balance.

You do not need to pay this money back and you will not be taxed on this money. Once activated, your money is safe on this card and is eligible for FDIC insurance. Be sure to immediately report if your card is lost or stolen. You can lock your card to prevent unauthorized transactions or ATM withdrawals while attempting to locate it. More information is available from the CFPB.